SIP ₹10,000 Monthly or Lumpsum ₹10 Lakh – Best Option for You?

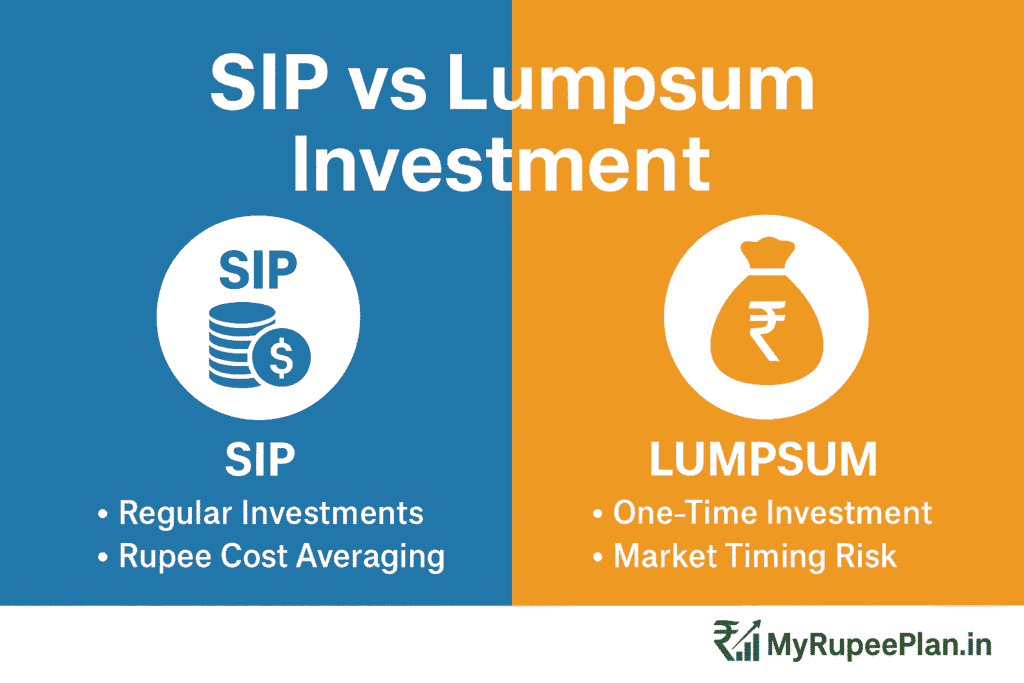

SIP ₹10,000 Monthly or Lumpsum ₹10 Lakh – Best Option for You? Introduction When it comes to investing in mutual funds, one of the biggest dilemmas investors face is: Should I invest through SIP or make a lumpsum investment?For example, if you have ₹10,000 per month to invest or a one-time ₹10 lakh, which approach […]

SIP ₹10,000 Monthly or Lumpsum ₹10 Lakh – Best Option for You? Read More »