🏠 50/30/20 Budget Rule: Smart Budgeting Strategy for Indian Households

Introduction

Managing money wisely is essential in today’s fast-paced life. The 50/30/20 budget rule offers a simple, flexible method to plan your finances. Whether you’re a salaried employee, freelancer, or homemaker, this budgeting strategy helps you track expenses and save efficiently.

What is the 50/30/20 Budget Rule?

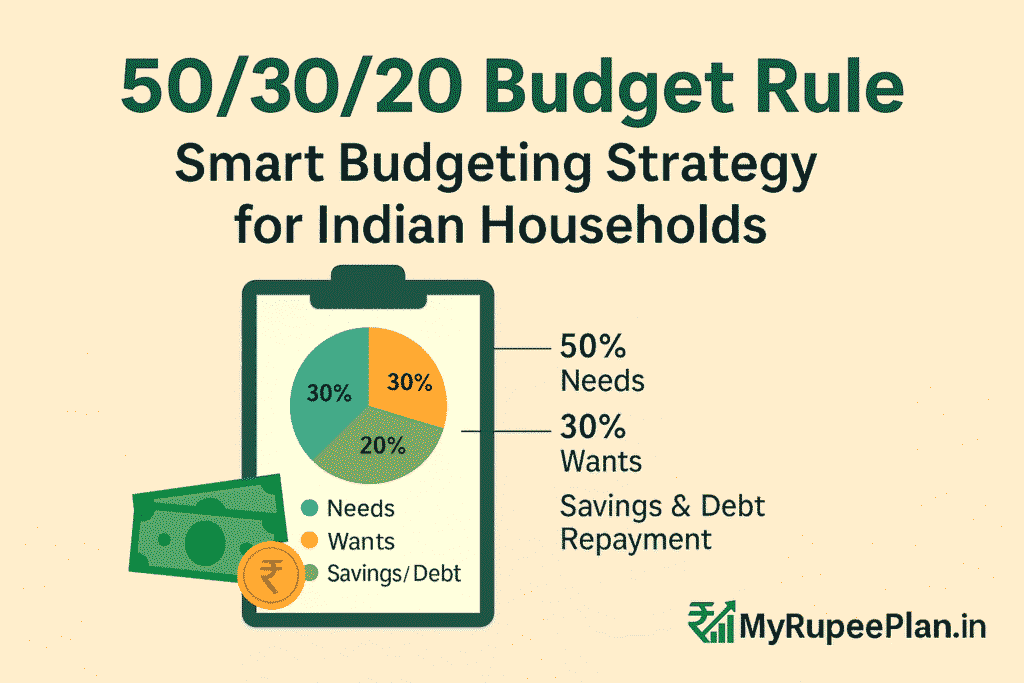

The 50/30/20 budget rule is a money management method that divides your monthly income into three categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings & Debt Repayment

This framework was popularized by U.S. Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan.”

How It Works in India

| Category | Percentage | Amount | Example Expenses |

|---|---|---|---|

| Needs | 50% | ₹25,000 | Rent, groceries, bills, transportation |

| Wants | 30% | ₹15,000 | Dining out, OTT, shopping, entertainment |

| Savings/Debt | 20% | ₹10,000 | SIPs, PPF, emergency fund, loan EMIs |

🔍 Breaking Down the Categories

✅ 50% – Needs

These are non-negotiable expenses. For most Indian families, this includes:

- House rent or EMI

- Utility bills

- School fees

- Groceries and daily essentials

- Basic transportation

✅ 30% – Wants

Wants are lifestyle choices—not necessary, but enjoyable:

- Dining at restaurants

- Netflix, Amazon Prime subscriptions

- Gym memberships

- Vacations, gadgets

✅ 20% – Savings & Debt

This portion secures your financial future. Include:

- SIPs and mutual fund investments

- Emergency fund

- Credit card/loan repayments

- Retirement plans like NPS, PPF

📊 Advantages of the 50/30/20 Rule

✅ Simplicity: Easy to understand and apply

✅ Flexibility: Adjust as per income changes

✅ Goal-Oriented: Encourages savings and debt control

✅ Improved Awareness: Tracks where your money goes

🤔 Is 50/30/20 Practical for Indian Households?

Yes, but with modifications based on income:

- Low-income earners: Needs may exceed 50%. Reduce wants to 20% and savings to 10%.

- High-income earners: Can increase savings up to 30–40%.

- Joint families: Consider total household income and shared expenses.

🧠 Pro Tips for Success

- Use budget-tracking apps like Walnut, Goodbudget, or Excel

- Review your budget monthly

- Automate savings through SIPs or RD

- Prioritize emergency fund over luxury spends

🧾 Example: ₹40,000 Monthly Income

| Category | % | Amount |

|---|---|---|

| Needs | 50% | ₹20,000 |

| Wants | 30% | ₹12,000 |

| Savings/Debts | 20% | ₹8,000 |

Even ₹8,000/month saved leads to ₹96,000/year!

🧾 FAQs: 50/30/20 Budget Rule

1. What is the 50/30/20 budget rule?

It’s a budgeting rule where 50% of income goes to needs, 30% to wants, and 20% to savings or debt.

2. Can Indians use the 50/30/20 rule?

Yes, it’s flexible and works well when adapted to Indian spending habits.

3. How do I calculate my 50/30/20 budget?

Multiply your monthly income by 0.5, 0.3, and 0.2 for needs, wants, and savings respectively.

4. What counts as a need or want?

Needs: rent, groceries, bills.

Wants: eating out, shopping, entertainment.

5. What if needs exceed 50%?

✅ Conclusion

The 50/30/20 budget rule offers a balanced and disciplined approach to money management. Whether you’re new to budgeting or looking to optimize your savings, this rule can be your roadmap to financial freedom.